About the authors:

Richard Bray is a partner and patent attorney. Richard works with a range of clients in technological sectors such as electronic consumer goods, defence, food products, and the more emerging technologies of autonomous vehicles, vehicular head-up displays, virtual and augmented reality, image guided therapy, nuclear (e.g. fusion), quantum security, and more.

Paul Roscoe is a senior associate and patent attorney. Paul has experience of subject-matter including engineering, electronics, and computer-implemented inventions, and in particular, artificial intelligence applications.

Tom Gregory is a trainee patent attorney. Tom’s work is primarily focused on the mechanics and electronics sectors. He also has valuable experience in computer-implemented inventions and software. Tom currently assists clients working in the fields of autonomous vehicles, defence and aerospace.

Key findings

- Artificial intelligence (AI) patents in aerospace and avionics have been accelerating in recent years

- Around 900 new patent families published in 2021, compared with around 200 in 2016

- Boeing Co. and SZ DJI Technology Co. Ltd. dominate the filing numbers

- A mix of new players and well-established names make up the list of assignees

Introduction

Artificial intelligence (AI), and machine learning have gained much media attention of late. Various commentators have raised questions such as whether it is a fad, whether it can be trusted, and whether it will ultimately take over. For us, as patent attorneys, we like to look at what the patent data can tell us. This field in particular is interesting because certain sectors, such as commercial aviation, are rather conservative, and other sectors, such as defence, oftentimes prefer to keep things a secret. In spite of such obstacles, we find evidence of an industry which has grown steadily in recent years, with room for industry giants and relative newcomers alike.

Specific innovations in this space

The data used to compile the charts in this article include some interesting innovations. There are patent documents that relate to an autonomous vehicle such as a drone programmed to perform specific tasks in a facility. Other patent documents relate to an unmanned aerial vehicle (UAV) specifically programmed to perform inspection tasks and to collect image data. This demonstrates some of the different technologies being developed and the potential breadth of their applications.

Trends

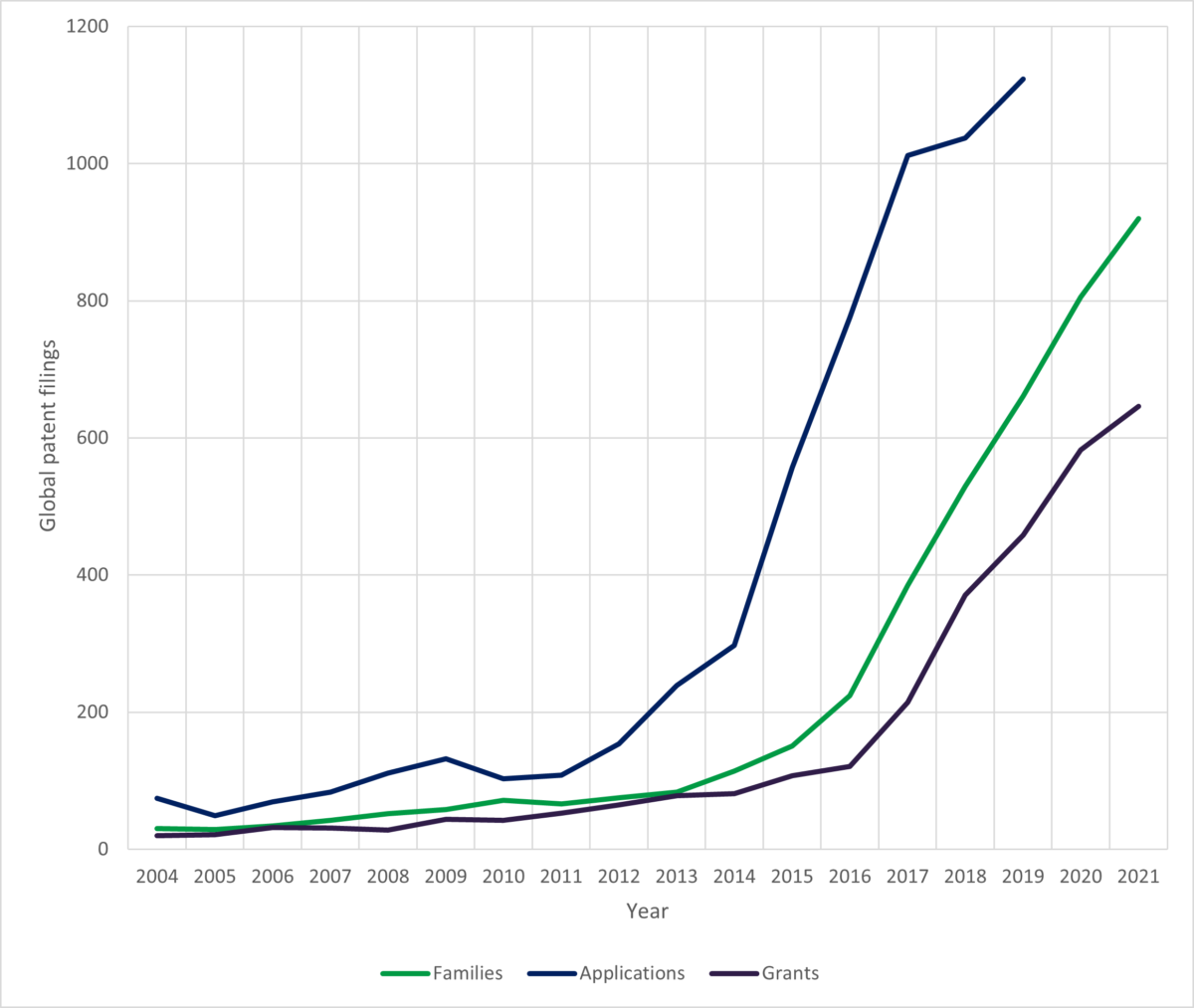

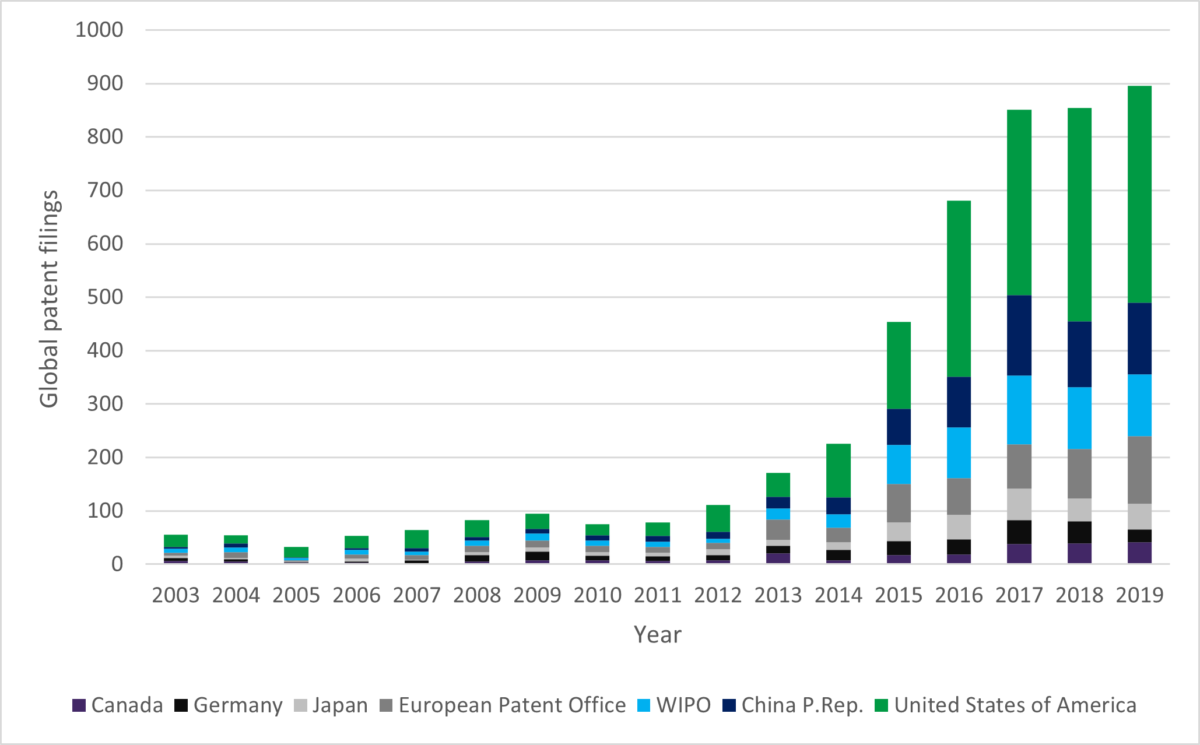

(Fig.1) Global AI patent filing trends in aerospace and avionics – 2004 to 2021

There has been a significant ramp-up in patent publications starting around 2013. This trend is consistent with other charts we have produced for other application fields where an AI innovation is involved.

The trends for core AI innovations are more exponential. Here the trends, especially the family and grant data, does increase but is more linear. There may be some reasons for that which we will explore here.

The large bulk of the present data set is made up of inventions relating to the emerging field of unmanned aerial vehicles, such as agricultural drones and delivery drones. However, a much smaller proportion of the data seems to focus on innovations specific to commercial aviation. This is perhaps unsurprising when considering that commercial aircraft need to be certified, which is a lengthy and involved process. Therefore, there may be a bias towards more conservative technologies. Perhaps because of this, whilst increasing annually, the trends in this space do not appear to have accelerated as quickly as other areas.

We are sometimes confronted with a view from inventors that “software is not patentable” and hear statements such as “you can’t patent an algorithm”. Anecdotally, we can explain that those notions are often incorrect. However, with fig. 1 we don’t have to do that. Fig. 1 clearly shows that patents are being granted for AI inventions in the fields of aerospace and avionics.

Overarchingly, it should be clear that if an applicant is considering filing a patent application in this space, they should do so sooner rather than later. The amount of prior art that is being generated as these patent applications publish will naturally make it harder to prove that the invention is both novel and inventive.

Jurisdiction breakdown

As part of the patent process, applicants are faced with a decision of where to file. Patents are territorial rights, meaning a patent granted in the US is enforceable in the US. To enforce the same invention in China, a granted patent is required in China. The number of countries is proportional to the costs. Therefore, there is a balance to be struck, and this is a decision any applicant has to make. In fig. 2 below we look at where applicants are choosing to file.

The data in 2019 includes the numbers of applications published in a country. The year 2019 has been used to accommodate accounting delays due to applicants who use the PCT procedure.

(Fig.2) Global AI aerospace and avionics patent filings by jurisdiction

The United States has been the largest territory for many years and continues to be so. China is the second largest territory with the European Patent Office (EPO) coming in third, albeit some way behind the US. This may reflect the extent of investment in these fields of each jurisdiction.

Who is filing what?

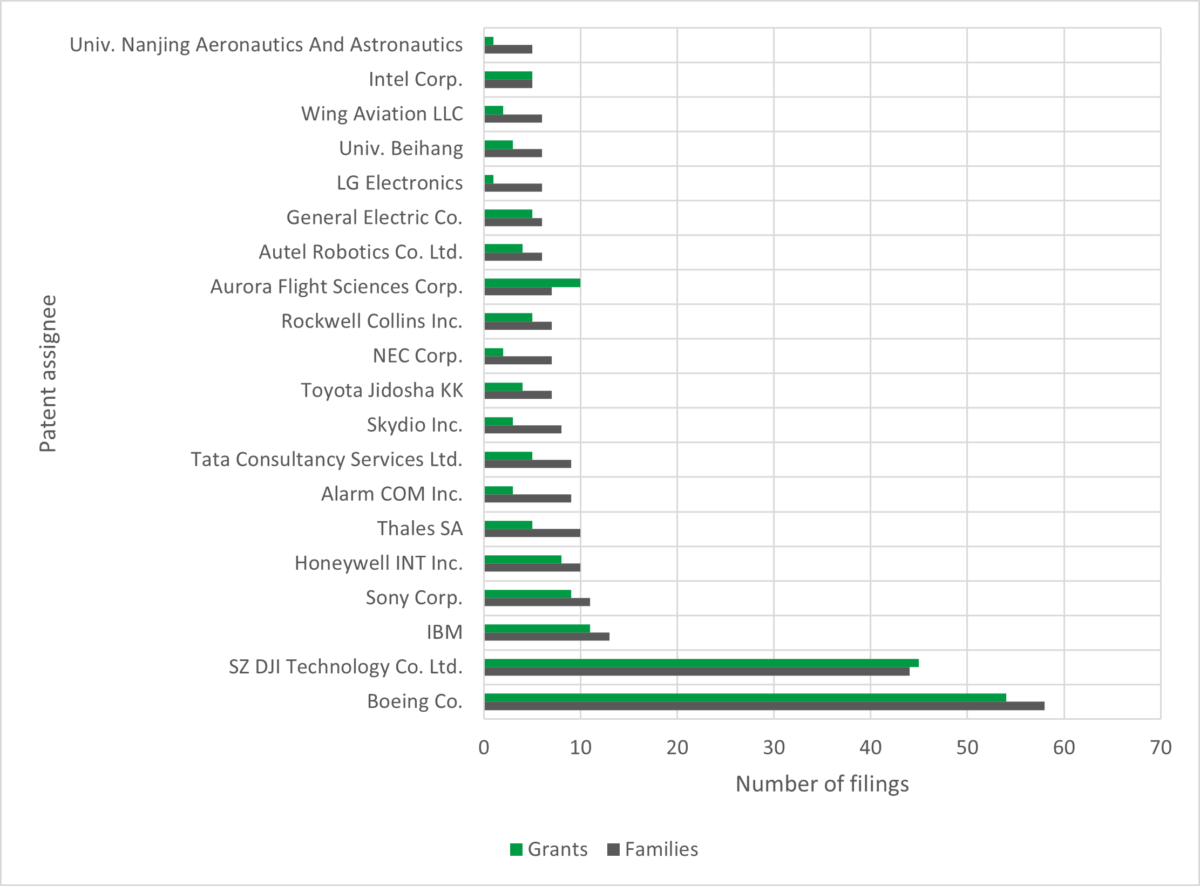

Fig. 3 below shows the top 20 assignees for last year, namely the calendar year of 2021.

(Fig.3) Top 20 AI patent assignees in the fields of aerospace and avionics

An applicant would not need many patent application to break into the top 20 assignees. Around 10 should do it.

Possibly unsurprisingly, Boeing Co. take the top spot in 2021 for the number of published families and the number of granted patents. SZ DJI Technology Co. Ltd. take second position. It is clear that both of these companies are focussing innovation on this space. While aerospace focused companies make up the bulk of the top 20 assignees, drone and UAV technologies are also well represented by the likes of SZ DJI Technology Co. Ltd. and Skydio Inc. in the top 10 alone.

Interestingly, this list includes OEMs such as Boeing, and also tech giants such as IBM and intel. This raises questions as to whether such companies can work together, in terms of both collaboration and resolving disputes surrounding potentially complementary patent filings. There has been recent litigation between Nokia and Daimler relating to FRAND issues. Could similar issues arise here? It will be interesting to see over the coming years.

Methodology

The data in this article has been generated using PatBase. To harvest the data, classification codes were used including IPC and CPC codes. Two groups of codes have been used. The first group includes codes classifying artificial intelligence and machine learning applications. The second group includes codes classifying aerospace and avionics applications. An intersection has been taken of the two groups to generate the data.

Visit our content collection for more on patenting autonomous vehicle innovation.